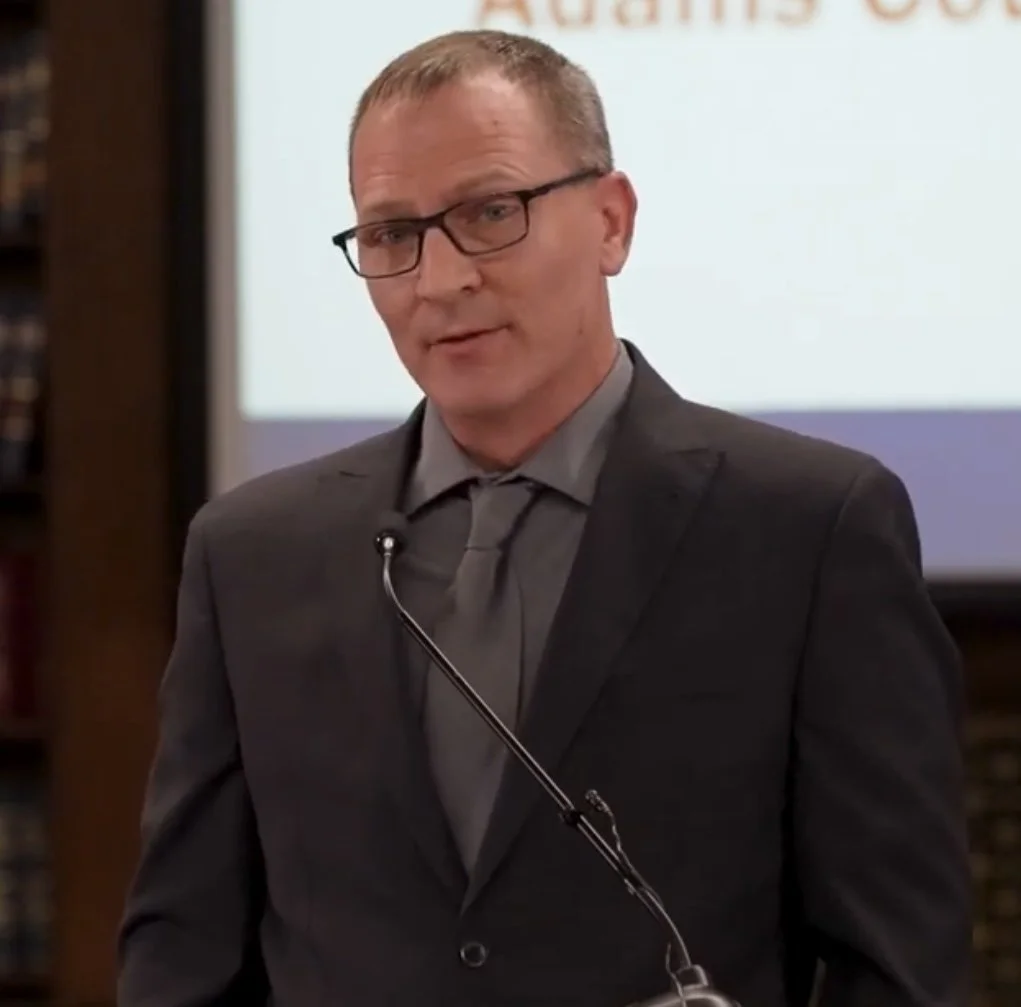

Thomas Swingle

Candidate

Adams County Assessor

Experienced. Committed. Ready to Lead.

I’m Thomas Swingle, and I’m running for Adams County Assessor to bring experienced leadership, modern tools, and transparent practices to property assessment.

With more than 20 years of hands-on experience, from GIS specialist to real estate appraiser to Deputy Assessor, I’ve dedicated my career to ensuring accurate, fair, and transparent assessments for the people of Adams County.

I hold a degree in Geography from the University of Northern Colorado and have built a career rooted in data-driven public service. This foundation allows me to ensure that property assessments are both accurate and equitable.

Core Values

✅ Experience You Can Trust

Over two decades of experience inside the Assessor’s Office, from boots-on-the-ground appraisal to senior leadership. I know how the office works and how to improve it.

💻 Advancing Assessment Through Technology

With deep expertise in GIS, statistics, and valuation tech, I’ve led innovation in how properties are assessed. I’ll continue modernizing systems to improve accuracy, fairness, and service.

🔍 Transparency and Accountability

You deserve to know how your property is assessed. I’ll make the process more understandable and the office more responsive, through clear communication and accessible tools.

Experience Timeline

-

Deputy Assessor, Adams County

Leading operations and oversight across departments to ensure equitable, transparent, and data-driven assessments. -

Real Estate Appraiser & Analyst

Evaluated complex residential and commercial properties with attention to market trends and fair valuation. -

Used mapping and spatial data to increase accuracy in parcel data and improve long-term land valuation.

-

B.A. in Geography – University of Northern Colorado

Specialized in spatial relationships, land use, and geographic information systems (GIS).

🌐 National & Regional Leadership Roles

IAAO GIS Task Force – Committee Member

URISA GIS Valuation Tech Conference – Program Committee

URISA GIS-Pro Conference – Program Committee

-

My Experience

22+ years in the Assessor’s Office

24 years of GIS expertise

12 years in comprehensive real estate appraisal

6 years of managerial experience

20 years of data analysis

3 years of statistical Regression Analysis

Professional Memberships

IAAO

IAAO GIS Task Force Committee

Geospatial Professional Network (GPN)

GIS Valuation Technologies Conference Committee

GIS-Pro Conference Committeegoes here

-

Property Assessment Process

Real property in the county is revalued every odd-numbered year to ensure accurate and equitable property values.

The actual value of real property is determined as of the appraisal date, which is June 30th of the year prior to the reappraisal year.

Residential property must be valued using only the market approach.

Under this method, the property’s value is estimated by analyzing comparable sales to predict the price it would have sold for on the Appraisal date.

-

Mass appraisal is a process that allows for valuation of a universe of properties on June 30th of every even year in order to produce uniform, fair, and equitable values.

-

Property Tax Formula

Property taxes are calculated using a simple formula:

Assessment Rate × Property Value × Tax Rate = Property Tax

Assessors are responsible only for determining one part of this equation - the property value. The assessment rate and tax rate are set by state law and local taxing authorities.

-

Geographic Information Systems (GIS) connect data to real-world locations. By displaying information on maps, GIS helps us see relationships, patterns, and trends that might otherwise go unnoticed.

Mapping & Layers

GIS maps are built from multiple layers, such as roads, land use, and property boundaries, stacked together to create a complete picture of an area. These layers can be turned on or off to explore how different factors interact in a place.

Analyzing Data

Beyond mapping, GIS performs spatial analysis. It can measure distances, highlight areas of high activity, or predict where certain conditions are likely to occur. This helps answer practical questions like where to build new infrastructure or how to protect natural resources.

GIS in Real Estate Appraisal

In a County Assessor’s Office, GIS plays a critical role in accurately valuing real estate and supporting transparency in the assessment process. It allows staff to visualize parcel boundaries, analyze neighborhood trends, and compare recent sales data directly on a map. By integrating aerial imagery, zoning, and land-use data, GIS helps appraisers analyze property characteristics, verify changes, and support accurate real estate valuations across the county. The result is a more transparent, data-driven appraisal process that improves efficiency and public trust.

Campaign Trail

Follow us on social

Support Fair, Transparent, Data-Driven Leadership

Support our mission by contributing a donation.

Thomas Swingle For Assessor

Thomas Swingle For Assessor

Contact Us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!